Main Street Development Director Christina Caudle told the panel the program is not included for funding in the upcoming fiscal year federal budget. “If the federal credits are eliminated, state tax credits will also be eliminated.”

State historic tax credits legislation is written as a piggyback credit to the federal program, she said.

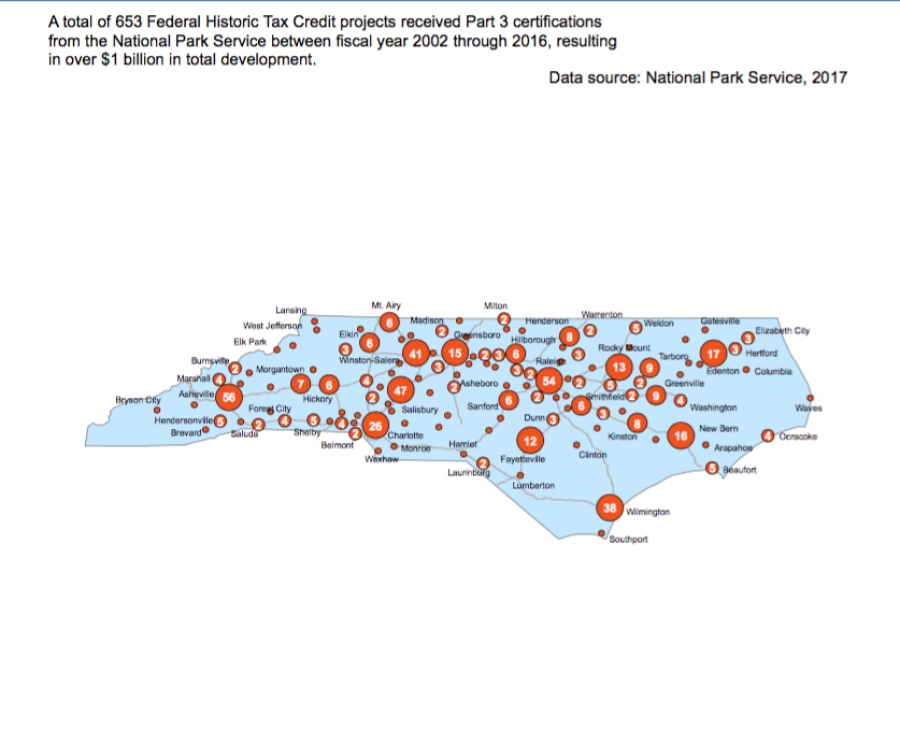

Since 1981, the credit has leveraged more than $131 billion in private investment, created more than 2.4 million jobs and preserved more than 42,000 historic buildings “that form the fabric of our nation.”

The program has been used successfully in Weldon.

(A fact sheet on the tax credit program is included as a PDF at the end of this story)

In Roanoke Rapids, which has the second largest historic district in the state, there are 1,163 contributing historic properties which could be eligible for federal and state historic tax credits. “These credits are a valuable economic development tool as many projects become financially feasible with use of these tax credits,” Caudle said.

Under the current program, properties deemed income-producing are eligible for a total of 40 percent in historic tax credits — 20 percent federal, 15 percent state and a 5 percent bonus for a Tier 1 county. Non-income producing properties are eligible for a 15 percent historic tax credit.

In a resolution which was unanimously adopted by council, the document notes, “ … the Roanoke Rapids City Council supports the efforts of the city’s Main Street program that advocates for utilizing uptown and downtown Roanoke Rapids historic buildings as a catalyst for economic development.”

A healthy, vibrant downtown “makes all of the economic development initiatives in the community easier to achieve,” the resolution says. “Many private investors have made significant investments in the community by investing in older, often vacant buildings.”

Says the resolution: “ … Roanoke Rapids City Council understands the importance and wealth of historic structures that offer unique opportunities by differentiating Roanoke Rapids from other communities and … (the) Roanoke Rapids Historic District may benefit from large and small historic preservation tax credit projects that could increase our tax base.”

Federal historic preservation tax credits could make otherwise unsuccessful projects an enormous success “and benefit to our community.”

The document, which is to be sent to the local federal legislative delegation and other partners involved in historic preservation projects, encourages the inclusion of the tax credits in the proposed 2017-18 federal budget.

Councilman Carl Ferebee said he would also present the resolution to the North Carolina League of Municipalities.

Caudle said North Carolina Downtown Development is doing lobbying on the state level. “A lot of things on the state level are occurring,” she said.

City manager bonus

In another matter this evening, council, after a closed session, agreed to give City Manager Joseph Scherer a $5,000 bonus.

The bonus was based on the city manager’s last evaluation. “I’m very honored council placed confidence and trust in me to manage the city’s administration,” he said.

Scherer is in his fifth year as city manager.